Plasma Fractionation Market Size to Worth USD 80.44 Billion by 2034

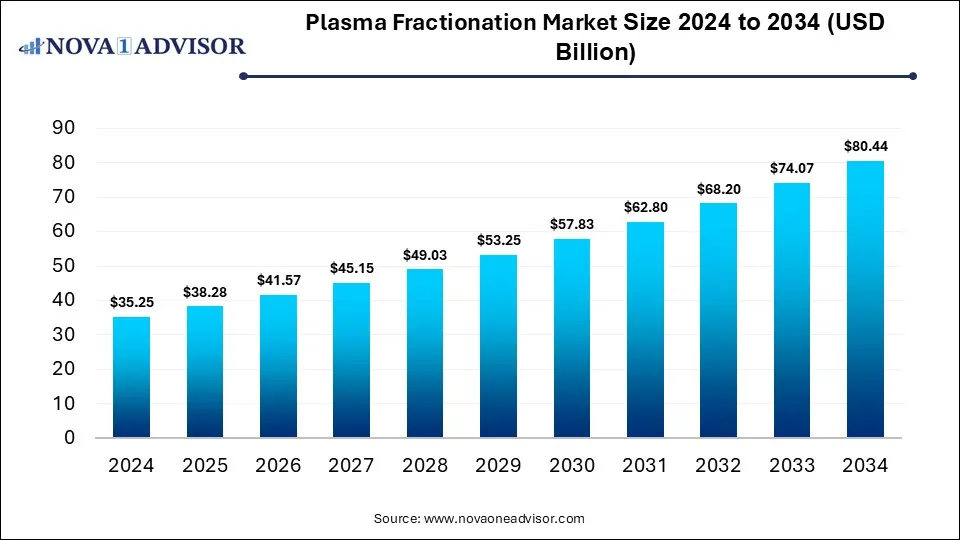

According to Nova One Advisor, the global plasma fractionation market size is calculated at USD 38.28 billion in 2025 and is expected to be worth around USD 80.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.6% over the forecast period 2025 to 2034. A study published by Nova One Advisor a sister firm of Precedence Research.

Ottawa, Nov. 19, 2025 (GLOBE NEWSWIRE) -- The global plasma fractionation market size is calculated at USD 35.25 billion in 2024, grows to USD 38.28 billion in 2025, and is projected to worth around USD 80.44 billion by 2034, growing at a CAGR of 8.6% during the forecast period 2025 to 2034. The market is growing due to rising demand for pharma-derived therapies to treat chronic and rare diseases, coupled with increasing awareness and advancements in fractionation technologies.

Key Takeaways

- North America dominated the plasma fractionation market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By type, the immune globulin segment held the largest market share in 2024.

- By type, the coagulation factor segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the hospital segment led the market in 2024.

- By application, the retail pharmacy segment is expected to grow at the fastest CAGR in the market during the forecast period.

Download a Sample Report Here@ https://www.novaoneadvisor.com/report/sample/6848

What is Plasma Fractionation?

Plasma fractionation is the process of separating blood plasma into its individual components, such as clotting factors, immunoglobulins, and albumin, for therapeutic and medical use. The plasma fractionation market is expanding rapidly due to increasing prevalence of chronic and rare diseases that require plasma-derived therapies, such as hemophilia, immune deficiencies, and liver disorders. Rising awareness about the benefits of plasma-based treatments, technological advancements in fractionation processes, and a growing donor base are also driving growth. Additionally, supportive government initiatives, rising healthcare expenditure, and the expansion of plasma collection centers worldwide are fueling the demand for high-quality plasma products, boosting the overall market.

According to the World Health Organization (WHO), approximately 118.5 million blood donations are collected worldwide each year. The amount of plasma available for fractionation varies between 0.1 and 52.6 liters per 1,000 people, with a median value of 5.2 litters.

What are the Key Growth Drivers of the Plasma Fractionation Market?

The market is driven by rising demand for plasma-derived therapies to treat conditions like hemophilia, immune deficiencies, and liver disorders. Growing awareness of plasma-based treatments, technological advancements in fractionation processes, and an increasing number of plasma donation centers contribute to market expansion. Additionally, supportive government initiatives, higher healthcare spending, and a rising global patient population are primary factors fueling the market growth.

- In 2024, over 900,000 kg of plasma were supplied to the industry for fractionation and the production of plasma-derived medicines, reflecting a 3% increase from 880,000 kg delivered in 2023.

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/6848

Plasma Fractionation Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 38.28 billion |

| Revenue forecast in 2034 | USD 80.44 billion |

| Growth rate | CAGR of 8.6% from 2025 to 2034 |

| Actual data | 2018 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Revenue in USD billion and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Product, Method, Application, End-use, Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada;, Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

| Key companies profiled | Grifols S.A.; CSL Limited; Takeda Pharmaceutical Company Limited; Octapharma AG; Kedrion S.p.A; LFB S.A.; Biotest AG; Sanquin; Bio Products Laboratory Ltd.; Intas Pharmaceuticals Ltd. |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

For more information, visit the Nova One Advisor website or email the team at sales@novaoneadvisor.com | Call us : +1 804 420 9370

What are the Key trends in the Plasma Fractionation Market in 2024?

- In September 2024, London-based biotech leader Epsilogen secured $16.4 million in a funding round to advance the development of its immunoglobulin E (IgE) antibodies for cancer therapy. The investment came from British Patient Capital, Novartis Venture Fund, Epidarex Capital, 3B Future Health Fund, and ALSA Ventures.

- In June 2024, Biotest, a global plasma protein and biotherapeutics provider under Grifols, received FDA approval to market Yimmugo, a therapy for primary humoral immunodeficiency (PI) in patients aged two years and above.

What are the Emerging Challenges in the Plasma Fractionation Market?

The market faces challenges, including limited plasma supply, high costs of collection and processing, and strict regulatory requirements for safety and quality. Additionally, technological complexities in fractionation, risk of contamination, and dependence on donor availability hinder growth. Market expansion is also affected by competition from alternative therapies and the need for continuous investment in advanced infrastructure and research to meet rising global demand for plasma-derived products.

Segmental Insights

By Type Insights

How did the Immune Globulin Segment Dominate the Plasma Fractionation Market in 2024?

In 2024, the immune globulin segment held the largest market share due to its widespread use in treating immune deficiencies, autoimmune diseases, and neurological disorders. Growing awareness of immunoglobulin therapies, increased prevalence of immunodeficiency conditions, and rising demand for intravenous and subcutaneous formulations contributed to this dominance. Moreover, ongoing product innovations, improved manufacturing, and strengthened the segment's position in the global plasma fractionation market.

The coagulation factor segment is expected to grow at the fastest CAGR due to the increasing prevalence of bleeding disorders such as hemophilia and von Willebrand disease. Advancements in recombinant technologies and plasma-derived factor concentrates are enhancing treatment effectiveness and safety. Rising awareness, improved diagnostic facilities, and greater access to specialized therapies are further fueling demand. Additionally, government initiatives and healthcare investments aimed at managing rare blood disorders are accelerating this segment’s growth.

Plasma Fractionation Market Size by Type, 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Albumin | 8.81 | 9.49 | 10.23 | 11.02 | 11.87 | 12.78 | 13.76 | 14.82 | 15.96 | 17.18 | 18.50 |

| Immune Globulin | 15.86 | 17.34 | 18.96 | 20.72 | 22.65 | 24.76 | 27.06 | 29.58 | 32.33 | 35.33 | 38.61 |

| Coagulation Factor | 7.05 | 7.69 | 8.40 | 9.17 | 10.00 | 10.92 | 11.91 | 13.00 | 14.19 | 15.48 | 16.89 |

| Others | 3.53 | 3.75 | 3.99 | 4.24 | 4.51 | 4.79 | 5.09 | 5.40 | 5.73 | 6.07 | 6.43 |

By Application Insights

What made the Hospital Segment Dominant in the Plasma Fractionation Market in 2024?

In 2024, the hospital segment dominated the plasma fractionation market due to the high volume of patient admissions requiring plasma-derived therapies for critical conditions like immune deficiencies, bleeding disorders, and liver diseases. Hospitals serve as primary centers for transfusion, diagnostics, and advanced therapeutic procedures. The availability of skilled healthcare professionals, well-established infrastructure, and advanced treatment facilities further supported hospitals' leading role in plasma product usage and overall market share.

The retail pharmacy segment is projected to grow at the fastest CAGR due to increasing patient preference for convenient access to plasma-derived medicines outside hospital settings. Expanding distribution networks, improved drug availability, and rising awareness of home-based treatments are driving this growth. Additionally, partnerships between manufacturers and pharmacy chains, along with supportive healthcare policies and rising chronic disease cases, are enhancing the retail channel's role in delivering plasma-based therapies efficiently.

Plasma Fractionation Market Size by Application, 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Hospital | 22.91 | 24.81 | 26.86 | 29.08 | 31.48 | 34.08 | 36.89 | 39.94 | 43.24 | 46.81 | 50.68 |

| Retail Pharmacy | 7.05 | 7.73 | 8.48 | 9.30 | 10.20 | 11.18 | 12.26 | 13.44 | 14.73 | 16.15 | 17.70 |

| Other | 5.29 | 5.74 | 6.24 | 6.77 | 7.35 | 7.99 | 8.67 | 9.42 | 10.23 | 11.11 | 12.07 |

By Regional Analysis

How is North America contributing to the Expansion of the Plasma Fractionation Market?

In 2024, North America dominated the market due to its strong healthcare infrastructure, high plasma collection rates, and advanced manufacturing capabilities. The region’s leadership is supported by the presence of major industry players, favorable regulatory frameworks, and significant investments in research and development. Additionally, growing demand for plasma-derived therapies, increased awareness of immunodeficiency and bleeding disorders, and well-established reimbursement systems further strengthened North America’s market position.

How is Asia-Pacific Accelerating the Plasma Fractionation Market?

The Asia-Pacific region is expected to record the fastest CAGR in the market due to rising healthcare investments, expanding awareness of plasma-derived therapies, and increasing prevalence of chronic and rare diseases. Growing plasma collection activities, supportive government initiatives, and improving healthcare infrastructure across countries like China, India, and Japan are driving regional growth. Additionally, the presence of emerging biopharmaceutical companies and rising demand for affordable treatment options are fueling market expansion.

Plasma Fractionation Market Size By Regional, 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| North America | 13.4 | 14.5 | 15.6 | 16.9 | 18.2 | 19.7 | 21.3 | 23.0 | 24.8 | 26.8 | 29.0 |

| Europe | 9.9 | 10.7 | 11.6 | 12.5 | 13.5 | 14.6 | 15.8 | 17.1 | 18.6 | 20.1 | 21.7 |

| Asia Pacific | 7.8 | 8.5 | 9.4 | 10.3 | 11.4 | 12.5 | 13.8 | 15.1 | 16.6 | 18.3 | 20.1 |

| Latin America | 2.5 | 2.7 | 2.9 | 3.2 | 3.4 | 3.7 | 4.0 | 4.4 | 4.8 | 5.2 | 5.6 |

| Middle East and Africa (MEA) | 1.8 | 1.9 | 2.1 | 2.3 | 2.5 | 2.7 | 2.9 | 3.1 | 3.4 | 3.7 | 4.0 |

Top Companies in the Plasma Fractionation Market

- Syntegon

- CSL Behring

- Mitsubishi Tanabe

- Octapharma AG

- Hualan Bio

- Kedrion S.p.A

- Takeda Pharmaceutical Company Ltd.

- LFB Group

- Intas Pharmaceuticals Ltd.

- Biotest AG

- Bio Product Laboratory Ltd.

Recent Developments in the Plasma Fractionation Market

- In August 2024, Nanoform Finland partnered with Takeda Pharmaceutical Company to develop pre-clinical plasma-derived therapies aimed at treating rare diseases, focusing on improving drug formulations and therapeutic performance.

- In September 2024, GEFD, a joint venture between Grifols and Egypt’s National Service Project Organization (NSPO), launched a national initiative to achieve self-sufficiency in plasma-derived medicines. The project includes a plasma lab, storage facility, 20 donation centers, and an advanced manufacturing plant.

More Insights in Nova One Advisor:

- AI in Life Sciences Market - The global artificial intelligence (AI) in life sciences market size was accounted for USD 2.45 billion in 2024 and is anticipated to hit around USD 15.46 billion by 2034, growing at a CAGR of 20.23% from 2025 to 2034.

- Dental Implants Market - The global dental implants market size was estimated at USD 5.45 billion in 2024 and is anticipated to hit around USD 12.83 billion by 2034, expanding at a CAGR of 8.94% from 2025 to 2034.

- Targeted DNA RNA Sequencing Market - The global targeted DNA RNA sequencing market size was valued at USD 12.55 billion in 2024 and is anticipated to reach around USD 73.91 billion by 2034, growing at a CAGR of 19.4% from 2025 to 2034.

- U.S. Dental Services Market - The US dental services market size was exhibited at USD 175.25 billion in 2024 and is projected to hit around USD 294.28 billion by 2034, growing at a CAGR of 5.32% during the forecast period 2025 to 2034.

- U.S. Livestock Monitoring Market - The U.S. livestock monitoring market size is estimated at USD 1.35 billion in 2024 and is anticipated to reach around USD 4.13 billion by 2034, expanding at a CAGR of 11.83% from 2024 to 2034.

- In Vitro Fertilization (IVF) Services Market - The global in vitro fertilization (IVF) services market size was estimated at USD 28.55 billion in 2024 and is expected to reach USD 66.30 billion in 2034, expanding at a CAGR of 8.79% during the forecast period of 2025 and 2034.

- Life Sciences IT Market - The global life sciences IT market size was estimated at USD 25.45 billion in 2024 and is expected to hit USD 69.01 billion in 2034, expanding at a CAGR of 10.49% over the forecast period of 2025-2034.

- U.S. Humidifiers Market - The U.S. humidifiers market size was estimated at USD 2.15 billion in 2024 and is projected to reach USD 4.54 billion by 2034, growing at a CAGR of 7.77% from 2025 to 2034.

- Digital Manufacturing in Life Sciences Market - The global digital manufacturing in life sciences market size was estimated at USD 36.0 billion in 2024, and it is expected to surpass around USD 153.3 billion by 2034, poised to grow at a CAGR of 15.59% from 2025 to 2034.

- Middle East AI In Patient Engagement Market - The Middle East patient engagement solutions market size was estimated at USD 183.75 million in 2024 and is expected to reach USD 1,373.35 million in 2034, expanding at a CAGR of 22.28% during the forecast period of 2025 and 2034.

- Middle East Cosmetic Surgery & Procedure Market - The Middle East cosmetic surgery and procedure market size was estimated at USD 2.15 billion in 2024 and is expected to reach USD 5.28 billion by 2034, growing at a CAGR of 9.41% from 2025 to 2034.

- Full Service CRO Market - The global full service CRO market size was estimated at USD 43.75 billion in 2024 and is expected to reach USD 89.67 billion in 2034, growing at a CAGR of 7.44% during 2025-2034.

-

CRISPR Technology Market - The global CRISPR technology market size is calculated at USD 6.25 billion in 2024, grew to USD 7.29 billion in 2025, and is projected to reach around USD 28.93 billion by 2034. The market is expanding at a CAGR of 16.56% between 2025 and 2034.

Plasma Fractionation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Nova One Advisor has segmented the global Plasma Fractionation Market

By Type

- Albumin

- Immune Globulin

- Coagulation Factor

- Others

By Application

- Hospital

- Retail Pharmacy

- Other

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/6848

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | Towards Chem and Material

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.